Dollar Cost Averaging in Crypto Perpetual Futures: Leveraging Strategy to Manage Market Volatility

Investing in the cryptocurrency market can be daunting, especially given its notorious volatility. However, one strategy that has proven effective in mitigating risk and optimizing returns is Dollar Cost Averaging (DCA). This strategy involves investing a fixed amount of money at regular intervals, regardless of the asset's price. In the context of crypto perpetual futures, particularly with high leverage like 75x on an exchange such as Bybit, DCA can help traders navigate the unpredictable market dynamics more effectively.

Understanding the Basics

Dollar Cost Averaging (DCA) is a straightforward yet powerful investment strategy. Instead of making a lump-sum investment, traders invest a fixed amount at regular intervals. This approach allows them to buy more assets when prices are low and fewer when prices are high, ultimately reducing the average cost per unit over time. For crypto perpetual futures, DCA can help manage the inherent volatility and potential for high leverage.

The Role of Crypto Perpetual Futures and Leverage

Crypto perpetual futures are a type of derivative contract that doesn't have an expiration date, allowing traders to hold positions indefinitely. These contracts are often traded with high leverage, meaning that even small price movements can lead to significant gains or losses. Leverage, such as 75x available on Bybit, amplifies both potential profits and potential losses. This is where DCA can provide a strategic advantage, enabling traders to spread their investments over time and avoid the pitfalls of trying to time the market perfectly.

Implementing DCA in Crypto Perpetual Futures with Leverage

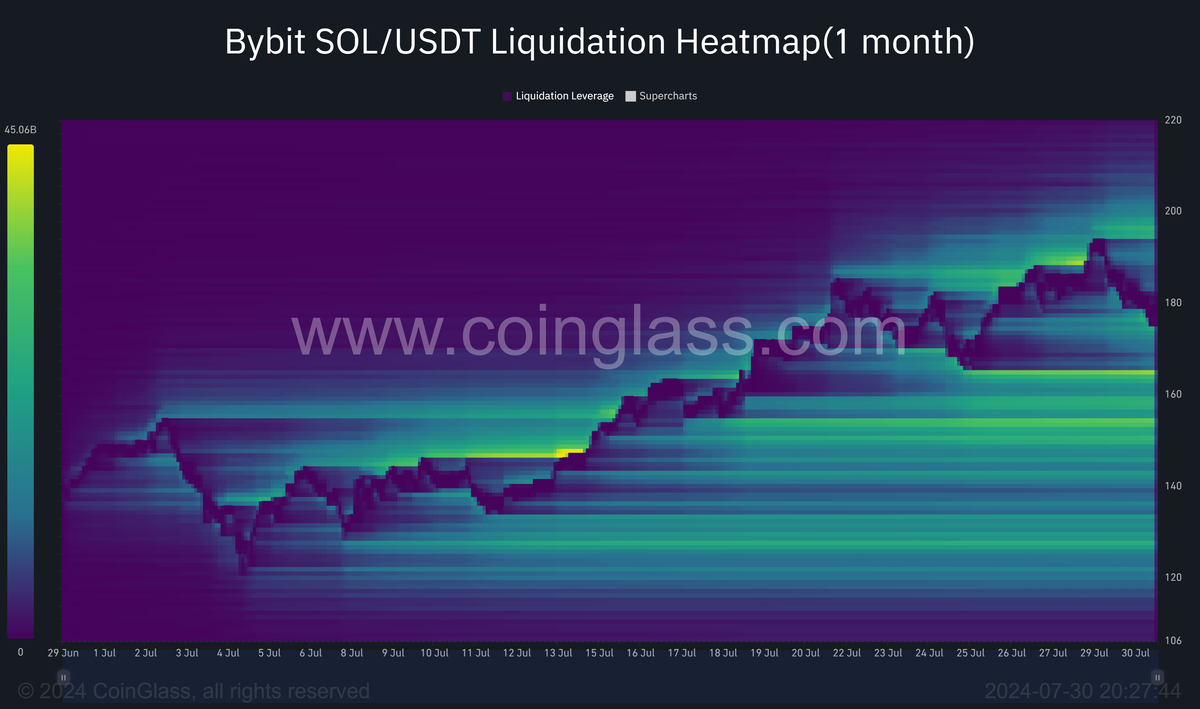

Let's consider a practical example using the provided chart of SOLUSDT perpetual contracts from Bybit:

- Initial Investment: Suppose you decide to invest $500 every week in SOLUSDT perpetual futures with 75x leverage. Regardless of the price fluctuations, you commit to this amount consistently.

- Regular Intervals: Over several weeks, you invest $500 at different price points. For instance, in the chart, you might invest when the price is $120.440, $138.373, $159.330, and so on.

- Leverage Application: With 75x leverage, your $500 investment effectively controls a position worth $37,500. This leverage amplifies both your potential gains and losses, making it crucial to manage risk effectively.

- Cost Averaging: By the end of a few months, you will have accumulated a significant leveraged position in SOLUSDT, with your average cost being the mean of all the prices at which you bought the contracts. This approach helps smooth out the volatility and reduces the impact of short-term price swings.

Incorporating Liquidation Heatmaps

The Bybit SOL/USDT Liquidation Heatmap provides valuable insights into where liquidations have occurred in the past month. This data can help identify price zones with high liquidity and potential support or resistance levels.

- Identifying Zones: The heatmap shows areas where significant liquidations have taken place, represented by color intensity. These zones can indicate potential support or resistance levels.

- Strategic DCA Points: By analyzing the heatmap, traders can choose strategic points to add to their positions. For instance, investing at price levels where the heatmap shows high liquidation activity can be advantageous, as these levels may serve as strong support or resistance zones.

- Managing Uncertainty: The heatmap also highlights the uncertainty of price levels. By using DCA, traders can mitigate the risk of investing all their capital at uncertain levels and instead spread their investments across different zones identified by the heatmap.

How to Use Liquidation Heatmaps Effectively

Magnet Zones: Concentration of potential liquidation levels within a specific price range may indicate that the price is likely to move towards that zone. Some traders utilize these liquidation levels to gauge the possible direction of price movement and as additional indicators for convergence.

Support/Resistance Zones: In high liquidation areas, larger traders or "whales" can execute trades rapidly at favorable prices. Once they enter or exit orders within this liquidity, the price can now reverse.

Furthermore, liquidation levels can exert significant pressure on either the buy or sell side of the order book, leading to a natural price reversal. Liquidations play a crucial role in the cryptocurrency market as they have a significant impact on traders' positions. By understanding how to utilize data from the liquidation heatmap, traders can make informed trading decisions and potentially increase their chances of success.

Advantages of DCA in Crypto Perpetual Futures with Leverage

- Amplified Returns: The use of leverage amplifies the returns on your investment. For instance, a 1% increase in the price of the underlying asset can result in a 75% return on your leveraged position.

- Reduced Emotional Impact: DCA helps remove the emotional stress of trying to time the market perfectly. Since investments are made at regular intervals, traders are less likely to make impulsive decisions based on short-term price movements.

- Mitigated Risk: By spreading out investments, traders can reduce the risk of entering the market at a peak price point, even when using high leverage.

- Consistency: DCA encourages a disciplined investment approach, which can be especially beneficial in the highly volatile crypto market.

Conclusion

Dollar Cost Averaging in crypto perpetual futures, especially with high leverage, offers a strategic approach to managing market volatility and leveraging the benefits of regular investments. By consistently investing a fixed amount over time, traders can reduce their average cost per unit, manage risks better, and potentially achieve more stable returns. Leveraging amplifies both potential gains and risks, making disciplined investment strategies like DCA even more critical. The addition of liquidation heatmap analysis provides an extra layer of insight, helping traders identify optimal zones for adding to their positions. As the crypto market continues to evolve, strategies like DCA will remain valuable tools for both novice and experienced traders.

By implementing DCA in your crypto perpetual futures trading with leverage and incorporating insights from liquidation heatmaps, you can navigate the complexities of the market with a more balanced and less stressful approach. Remember, the key to successful trading is not just about making profits but also about managing risks and staying disciplined.